The effective dispersion of carbon nanotubes (CNTs) is critical to their commercial success in applications such as energy storage and polymer composites. Their high aspect ratio and strong van der Waals forces lead to agglomeration, limiting performance if not properly managed. Achieving a uniform, stable dispersion is essential to fully realize CNTs’ electrical, mechanical, and thermal benefits, while also reducing required loadings and improving processing. As the market evolves, dispersion is increasingly seen not just as a technical challenge, but as a key factor in product performance and scalability.

Dispersions hold the key for CNT success. Image Credit: IDTechEx

Dispersions hold the key for CNT success. Image Credit: IDTechEx

The IDTechEx report, “Carbon Nanotubes 2025–2035: Market, Technology, Players”, provides a comprehensive overview of the CNT market, including in-depth analysis of key application areas, leading industry players, and granular 10-year forecasts for CNT demand (in tonnes per annum) and market value (in USD), segmented by application. With over a decade of experience covering the nanocarbon sector, IDTechEx delivers an independent, third-party assessment offering valuable insight into this evolving market.

Multi-walled carbon nanotubes (MWCNTs) are used in various applications, but their most impactful roles are as additives in energy storage and polymer systems. With growing demand for electrification, the CNT market is rapidly expanding. In lithium-ion batteries, MWCNTs enhance conductivity and mechanical strength, enabling higher energy density, thicker electrodes, and broader operating conditions. The IDTechEx report provides detailed analysis of dispersion methods, binder compatibility, and additive interactions, and also explores emerging developments in supercapacitor applications.

Key Applications for Dispersions

Whether used in standalone polymer matrices or fiber-reinforced composites, CNTs offer valuable benefits as additives, including improved interlaminar strength and enhanced electrostatic discharge performance. While established in applications like fuel systems and electronic packaging, increasing volumes from the energy storage sector and declining costs are expected to enable wider adoption across new markets over the next decade.

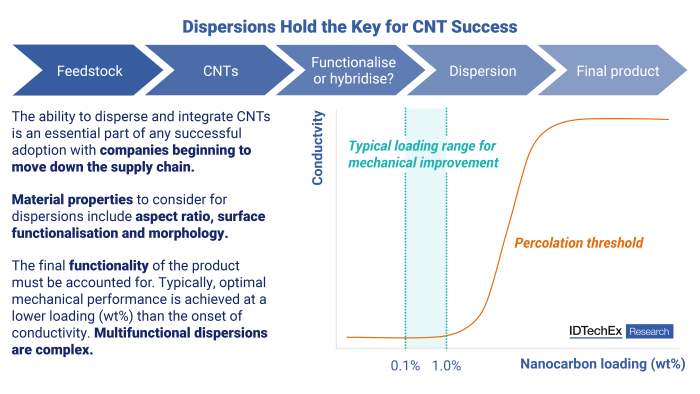

The main incentive for dispersing nanocarbons in polymer composites is to provide multifunctional properties. Mechanical properties are typically at the fore. Fracture toughness can be improved through mechanisms such as crack deflection and/or crack bridging, while applied stress and strain can be transferred from the matrix to the nanocarbon reinforcing agent through interfacial contact. Further mechanical properties that could be improved include impact resistance, interlaminar shear strength and compressive strength. Beyond mechanical properties, conductivity can be imparted with low loadings (<3 wt %) above the percolation threshold. Multifunctional conductivity can enable applications such as lightning strike protection, de-icing and thermal management.

Technical Challenges

A major problem for CNTs is translating the often hyped, superlative qualities to the macroscale in a tangible product. CNTs boast impressive properties, including tensile strength, thermal conductivity, electrical resistivity and charge carrying capacity, but CNTs are not a magic powder that can be sprinkled into a composite formulation to unlock increased performance. Incorporating the material into a polymer can involve masterbatches, while energy storage applications typically use a conductive slurry containing CNTs and other carbon materials such as carbon black.

Many challenges exist when considering CNT dispersions. Achieving a homogeneous dispersion of nanocarbons through a polymer matrix is not a straightforward activity, especially when considering the forming and molding of plastic components. Adding nanocarbon additives can impact the flowrate and viscosity of composites for extrusion molding, while multistep processes for fiber laminates may require alterations to the curing times given the presence of the new additive.

Since being acquired by leading carbon black player Birla in 2023, Nanocyl has developed a hybrid carbon black and CNT material for conductive polymers. The hybrid material bridges the gap between the two materials, but some difficulties remain, particularly around dispersion. CNTs disperse under high shear, while CB disperses at low shear. To overcome issues with dispersion for end users, masterbatches are provided in PP, PC and HIPS, all with a combined 30 wt% of the hybrid nanocarbon.

An often-seen misunderstanding for nanocarbon composites is the concept that one size fits all – in that one material can provide all property enhancements, in all matrices. Different grades of CNTs are suited for different applications, while the amount of additive required varies by application. Typically, optimal mechanical improvement can be seen for loadings around 0.1 to 1 wt% and even lower, while the conductivity threshold usually exists at a higher loading. As such, multifunctionality is difficult to optimise across a range of metrics such as mechanical and conductive properties, however thermal and electrical conductivity are often seen operating complementarily.

Commercial Success

A key challenge in utilizing CNTs is achieving a homogeneous, non-agglomerated dispersion, which is essential for maximizing performance and enabling lower loadings. While many companies claim in-house capabilities for effective dispersion, there is a growing trend toward outsourcing this process to specialized third-party providers. Specialist players such as Toyocolor and NanoRial are emerging, with the latter operating in partnership with companies such as CATL and NEO Battery Materials.

Internal and in-house capabilities should not be dismissed, with several CNT players moving downstream and seizing more of the value chain. LG Chem have established extensive vertical supply chains to provide CNTs for energy storage applications, typically applied as a conductive slurry. Cnano are a global leader by manufacturing capacity and provide both CNT powders and pastes to the market, with IDTechEx analysis showing that the sale of pastes has accounted for more than 95% of received revenue, annually, over the period from 2018 to 2024 showing the importance of moving downstream for CNT suppliers.

“Carbon Nanotubes 2025–2035: Market, Technology, Players” offers a definitive analysis of the CNT market. Drawing on IDTechEx’s extensive experience in nanocarbons, the report combines in-depth technical insight with an interview-led approach to deliver objective market forecasts, thorough benchmarking, and detailed evaluations of key players in this fast-evolving industry.