|

This article describes ten lessons that entrepreneurs in science-based fields, such as nanotechnology, can and should learn from the photonics bubble of the late 1990’s. Each lesson illustrates an avoidable error, made by many previous entrepreneurs, which led to the failure of a number of startup endeavours.

Introduction

In the eighteen month period from the start of 2000 to the middle of 2001, more than $2.5 billion of venture capital was invested in companies developing photonics components for telecom applications. Many of those companies no longer exist, and of those that do, most are struggling to survive, with their founders and investors having lost all hope of realising a return on their investments of sweat and money.

There are, however, some survivors - and a small number even appear poised for considerable success. In the course of studying the industry and working with many of these companies over the last four years, we have come to believe that there are some common themes underlying the failure of most of this crop of startups. While one of these themes was the general swing from the euphoria of an investment bubble to an overall telecom industry retrenchment, the others relate to errors that could have been avoided, and which apply quite generally to commercialisation of new technology. This article is an attempt to abstract from our work some important lessons for future entrepreneurs.

While these lessons are derived from a study of companies commercialising photonics, we think they apply far more generally. Photonics, like electronics, biotech, and nanotechnology has the characteristics of being heavily science based making possible the previously impossible impacting multiple markets

We believe that the lessons derived here apply to each of these technologies, and to others that share these characteristics.

Research or Business Creation?

As shown in figure 1, a technology passes through two major stages on its way from conception to commercialisation: the research phase and the business creation phase (which includes product development). Many companies in the photonics bubble were really in the research phase, but convinced the financial community, and often themselves, that they were in the business creation phase. That was fatal.

|

|

|

Figure 1. Research and business.

|

While it is possible (albeit hard and unusual) for a startup company to operate successfully in the research phase, there are fundamental differences between such a company and one in the business creation phase (table 1). These mandate different organizational structures, different human resources, and different financing models. It is critical to be totally honest with all concerned about the stage the technology is really at, and then create an organization matched to that reality.

Table 1. Characteristics of two technology phases

|

|

|

Cashflow

|

slow & steady

|

fast & accelerating

|

|

Focus

|

technological advancement

|

solving a need

|

|

Skills

|

technical

|

technical, market definition, finance, operations

|

|

Duration

|

unpredictable

|

scheduled

|

|

Funding

|

government/ industry R&D

|

VC, public equity

|

In most cases, success requires transition as soon as practical from a research phase to a business creation phase. For companies still in the research phase, biotech provides some interesting models of how to build a successful business. Non-biotech venture capital is very heavily focused on startups in the business creation phase, because the track record of creating successful returns from investing in research-phase technologies (outside biotech) is poor.

Lessons 2-10 that follow apply primarily to companies in the business creation phase.

Customers, Needs, & Products

A business is an organisation designed to deliver to customers, products or services that meet some set of needs those customers have. The needs must be significant enough that the customers will pay more for the products than it costs to produce them. There must be enough of those customers so that the size of the market is sufficient for profits to cover the costs of running the organisation, developing the products, and marketing and selling them.

Frequently, photonic-bubble startups were unable to articulate clearly what customer need they were addressing, who those customers were, and in some cases even what product they actually were going to manufacture. Being able to do this is a precondition for creating a successful business, and the graphic of figure 2 illustrates the key ingredients.

|

|

|

Figure 2. Customers, needs and products

|

The words customers and needs are important ones. For a telecom laser company, system vendors such as Lucent are not really what we have in mind when we talk of customers, and Lucent’s “need” for a cheaper laser is not the need in question. The real end customer is the service provider, and the real end need is the need to transmit data at some data rate over some distance.

As an illustration of how important this distinction is, many companies developed products (such as lasers) to meet a demand from vendors such as Lucent. However it turned out service providers already had sufficient data carrying capability, and therefore they did not need Lucent’s products, and therefore no-one bought the lasers. The correct thought process would have been to understand in detail the needs of service providers, their plans for network expansion, and their likely deployment of new systems and new network architectures. With this knowledge a meaningful articulation of the startup’s customer-need-product-technology linkages could be made.

The details of this articulation matter a great deal. For example, being in the business of “applying photonics to telecom”, is not at all the level of detail required. Even “making integrated optics for DWDM systems” lacks adequate precision for action. What is required is a detailed description of the need and the specific end user, as well as a detailed description of the required product functionality.

We already know of nanotech startups falling into this trap. Companies whose business plan is no more precise than to talk about applying nanotechnology to solar cells, or creating memory based on nanotubes would be good examples.

Tomorrow’s Product not Today’s

Entrepreneurs are often advised to “talk to customers”. All too often this is interpreted as “ask them what they need”. While always valuable, this is by no means sufficient. One of the many reasons is that customers generally talk about what they want today. The problem this poses is illustrated in figure 3.

|

|

|

Figure 3. Tomorrow’s products not today’s.

|

Market requirements change over time, generally becoming more demanding. A product can certainly be specified based on what customers need today. However product development takes time (several years typically), and when the product is ready to be sold, the market requirements will most likely have changed.

Many photonic-bubble companies have today products that would have been successful if introduced in 2000. However they are woefully unsuited to what is needed in 2004.

An important product definition task is to determine the requirements for a product that will be needed a few years in the future, when development will be completed. This is extremely difficult, but nonetheless absolutely vital.

Superior Solution Required

Even companies that do a good job of identifying a real customer need, and creating a product that meets that need, will fail if someone else offers a better (or equivalent but cheaper) solution.

Entrepreneurs have a tendency to be very on top of alternative approaches that use the same type of technology as they do, or which are generally similar product concepts. Frequently they are blind sided through not considering alternatives based on different technologies, or very different product concepts that meet the customer need in a different way.

As an example, a photonic solution to a problem might seem attractive until the relentless march of Moore’s law makes an electronic solution viable. Similarly, those developing nanotechnology-based solutions for “when Moore’s law reaches its limits” need to beware of betting against the creativity of CMOS engineers.

Being One of Many is Bad

Venture capital has a tendency to fund companies in waves as ideas become “hot”. Today we see a number of social networking startups. In the past we saw numerous companies started in the photonics space with very similar product ideas. It is likely this phenomenon will repeat itself in fields such as nanotechnology.

There are two problems with this. First, it raises the hurdle for success because this flock of startups competes fiercely for survival. Second, even if several of the startups survive, their revenues will be far lower than hoped as a result of all sharing the same total addressable market.

As an illustration, the datacom transceiver market, at more than $300 million in 2003, is a real market that would support one, two or even three companies in comfort. Today there are over 20 companies attacking the space. They are all competing fiercely on price, and as a result none is profitable. And none of them has a very large market share.

So, while there is comfort in being one of the crowd, it makes success very difficult. Although it is harder to raise financing for a novel idea, we believe there is a small group of venture capital firms that specialise in supporting just those novel ideas. We believe that uniqueness is a valuable asset, although of course it makes it even more critical that the customers, needs, and products can be clearly articulated.

Advantage Must be Sustainable

Many large companies pursue the fast follower strategy, by which they avoid pioneering new markets but instead wait for a startup to develop a market segment sufficiently for the potential to be clear. At that point they swoop in and use financial muscle and strong customer relationships to gain market share.

For a startup that has done a good job of product development, early customer cultivation, and IP barrier creation, the most likely outcome would be that the large company would buy them. This is just fine. However, in a situation where the large company can rapidly create a similar or better product offering, and the IP barriers are weak, the pioneering startup may find itself a wreck on the roadside as history moves past it. A classic example of this in recent times would be Netscape.

Thus it is key that the startup create some source of sustainable competitive advantage that makes acquisition preferable to competition. One such source of advantage is intellectual property, but there are others that may sometimes be superior.

In the case of IP, one side point that we would like to make is this. Many entrepreneurs concentrate on creating IP that protects their invention. However a more useful piece of IP is one that erects a barrier to competitors creating a solution to the customer’s need. This is hard to do, not least because it requires clear understanding of the customer need, alternative ways it might be met, and competing products.

Many IP attorneys lack the appropriate business knowledge to take these factors into account, and it is important to either team the attorney with members of the business development team, or find those rare attorneys who’s knowledge encompasses the relevant market insight in addition to their legal expertise.

Need an Entire Ecosystem

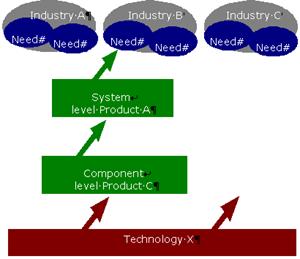

Figure 4 illustrates a common scenario in which a core technology (read photonics or nanotechnology) is used to create components that enable unique system level products, that meet a specific, hitherto unmet customer need in a particular industry. The real value in this situation only accrues when the system-level product is deployed.

|

|

|

Figure 4. Need for the entire ecosystem.

|

By the way, this is one reason for the very lengthy development times associated with component startups. Not only do they have to develop the component products, but significant revenue occurs only after their customers have completed development of system level products, and then sold them to the ultimate customers.

Very commonly the component level product is a small part of the system, and the system can reach its true potential only after several other subsystems or components have been brought to market. A number of photonic-bubble companies found themselves with market ready, component-level products that would have enabled truly valuable system level products. Unfortunately, system vendors are not yet developing those products because some of the critical subsystems that would go into them have not been commercialised.

This highlights the need for a complete ecosystem, comprised of all the players needed to participate in getting a functional system-level solution to the customer. A model for the way to do this is provided by Intel, which in initiatives such as their Centrino mobile chip sets, or WiFi, or the advanced TCA system architecture has successfully created entire ecosystems focused on an end product needed as a vehicle for Intel silicon.

It is hard for a startup to duplicate this of course (Intel spends hundreds of $millions on this ecosystem encouragement). Nonetheless the lesson is clear. There needs to be a way that the complete necessary ecosystem will exist, or there will be a roadblock to success.

One side effect of this is that, in the early stages of technology maturation, materials and component-level products that stand alone are easiest to commercialise. So as an example, deploying nanotechnology in the form of particles in sunscreen is far less problematic than creating a photonic switching technology that would enable a fundamentally superior telecom networking architecture, but that also needs new communications and signalling software which remains far from commercial reality.

Big Investment Needs Big Market.

Investment arithmetic is pretty straightforward. Venture capitalists need to believe an investment has the potential to realize a rather high return on investment (60% per annum for early stage deals), because only a small percentage of investments actually work out as hoped.

That means that the longer it takes to develop a product or the more capital that is required, the larger must be the potential market if the investment is to be justified. With science-based companies routinely requiring tens of millions of dollars of capital and taking 5-7 years (at best) to generate serious revenues, many business plans need billion dollar markets to be attractive investments.

Such large markets are relatively rare and this is a problem. Many photonic-bubble startups either misunderstood the market size or neglected to think deeply about it. Once investors realised that the market would fall below an attractive level, and the capital and time required did not decrease correspondingly, such companies found it almost impossible to attract additional capital. Many failed as a result.

The conclusion from this is that capital intensive projects with modest markets are unlikely to be funded by private equity. Sometimes such projects make a lot of sense within a larger company, however, and this should be carefully considered by entrepreneurs thinking about spinning off a technology into a new venture.

Balanced Execution is Key

Many photonic-bubble startups spent millions of dollars to create a product, only to fail when the customers did not want it.

We believe that this was generally due either to failure to act on one of the other lessons of this article, or to a fundamental execution error, described in this section. This fundamental execution error has to do with misallocation of resources, so as to overweight technology development at the expense of developing the commercial aspects of the business.

New business initiatives are about creating value. In our white paper entitled Value Creation Has Two Dimensions (available upon request), we illustrate this by means of figure 5, below. This figure depicts the creation of value, represented by the rectangular coloured areas, as a result of progress along two axes: the technical and the commercial. The amount of value created is represented by the size of the rectangle, and is maximized when progress is made in parallel along both axes.

|

|

|

Figure 5. (a) Neglecting commercial progress and (b) balanced progress.

|

Unfortunately, the example of figure 5a, in which progress is made primarily along the technical axis, is one which we see all too commonly. Just think how many startups and advanced development groups have technical development teams of tens of engineers, but only a single individual tasked with making progress along the commercial axis.

It is tempting to believe progress can first be made along the technical axis, thereby eliminating substantial risk, and subsequently along the commercial axis. However, because of the way in which technical and commercial milestones interrelate, this commonly results in development of the wrong thing.

Disruptive vs Sustaining?

In their book, The Innovator’s Solution, Clayton Christensen and Michael Raynor discuss at length the nature of innovation. They make a compelling argument that new business initiatives that target certain types of innovation (which they call disruptive) are far more likely to succeed than initiatives based on what they call sustaining innovation. On the other hand, they argue that for large established businesses, sustaining innovations make a great deal of sense.

In figure 6 we summarize the differing market and customer conditions likely to favour sustaining and disruptive innovation. It is very important to realise that new technologies such as nanotechnology can be introduced to the market either as sustaining or as disruptive innovations depending on the exact nature of the product and customer need being targeted.

|

For a defined (perceived) customer need,

do products with acceptable price/performance exist?

|

Are customers willing to pay

for better performance?

|

|

NO

|

YES

|

|

Disruptive innovation:

product that meets perceived

customer need with acceptable

price/performance

|

Disruptive innovation:

product with adequate performance and

lower cost/smaller size or other features

|

Few of them

|

|

Blend

|

Half of them

|

|

Sustaining

product with better performance

|

Most of them

|

|

|

Figure 6. Disruptive or sustaining.

|

The Innovator’s Solution suggests strongly that startups wishing to grow and have a long term existence would profit from targeting disruptive innovations. Startups that have the goal of creating a next generation product and being immediately acquired may well be able to do so by means of a sustaining innovation.

A number of photonic-bubble startups pursued what appears to be a sustaining innovation, and tried to compete with large established companies. Christensen’s and Raynor’s work would predict this strategy to have a low probability of success, and for cases we studied that was indeed correct. We strongly recommend incorporating this disruptive vs sustaining classification into market entry strategies.

Takeaway Message

Perhaps our takeaway message is best paraphrased in the words of the philosopher George Santayana.

“Those who do not remember the past are condemned to repeat it.”

By intent each lesson described here is outlined rather briefly. We can talk about each one at length and enjoy doing so, and we would welcome any feedback or dialog about the ideas expressed here. Please feel free to contact us.

|