|

In 2005, the National Science Foundation (NSF) awarded a grant to the National Center for Manufacturing Sciences (NCMS) to poll over 6,000 senior-level executives in leading U.S. organizations with leadership, technology or strategic research and development (R&D) responsibility to assess the outcome of growing private and public investments made in nano-technology under the National Nanotechnology Initiative (NNI). The overarching objective in conducting this largest known cross-industry benchmark study was to determine whether surveyed organizations treat nanotechnology differently from any other generation of advanced science and technology. The metric established by NSF was 300 survey responses to develop a credible profile – the survey netted 594 completed responses, representing a response rate of 10%.

Aggregate Observations

The NCMS survey of nearly 600 industry executives indicates that the state of the U.S. Nanomanufacturing Industry is generally vital, innovative and competitive for demonstrated passive nanotechnology products with many two-dimensional (2D) product applications growing rapidly for end-uses across diverse industry sectors. The survey confirms that the U.S. has the best-developed and mature research facilities, entrepreneurial culture and governance infrastructure for promoting new nanotechnology driven economic development.

Proliferation of Nanotechnology Start-ups

Besides the numerous entrepreneurial start-ups and small businesses (often led by researchers with academic or government laboratory connections), many larger manufacturers of conventional industrial materials and products as well as original equipment manufacturers (OEMs) and end-users, have begun to pursue internal research, actively seek new technologies, and partner in order to evaluate the potential for incorporating nanotechnology in differentiating their current product lines. Some of the world’s largest manufacturing organizations are actively developing their own pipelines and strategies for future products by adopting the specialized techniques to leverage risks and penetrate new markets with nanotechnology. Corporate partnering is critical for embryonic nanotechnology businesses to attain growth and viability; it begins anywhere from peer relationships to technology co-development and co-marketing, to culmination in merger and acquisition.

Diverse Nanotechnology Products in Development

Aggregate survey responses indicated that the U.S. Pacific region leads the Nation in development of diverse nanotechnology products and application markets that are being pursued for potentially disruptive economic, social, environmental and military advantage (Figure 1). Table 1 lists these applications.

Figure 1. Geographical distribution of 594 respondents corresponds closely with major public investments in nanotechnology

Table 1a. Nanotechnology products and major application markets

|

|

|

Nanotechnology Products

|

|

|

|

|

|

|

|

Semiconductors, nanowires, lithography & print products

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Coatings, paints & thin films

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Nanostructured particles, nanotubes & self assembly

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Drugs delivery, diagnostics & implants

|

X

|

X

|

X

|

|

|

X

|

|

Nano-bio, nanofluidics & tissue engineering

|

X

|

X

|

X

|

|

|

|

|

Catalysis, battery, fuel cells & filtration

|

X

|

|

|

|

X

|

X

|

|

Environmental sensing & remediation

|

X

|

X

|

|

X

|

X

|

X

|

|

Defence, security & protection

|

X

|

X

|

|

X

|

X

|

|

|

Electronic devices, displays & optoelectronics

|

X

|

X

|

X

|

X

|

X

|

|

|

Nano-manipulation, visualization, biomarkers & Q-dots

|

X

|

X

|

X

|

|

|

X

|

|

Computing, design, imaging tools, & products

|

|

X

|

X

|

|

|

|

|

Personal care, nanofluids & colloids

|

|

|

|

|

|

X

|

|

Convergence products (Nano-bio-IT-cognitive)

|

|

|

X

|

|

|

|

|

Other

|

|

|

|

|

|

|

Table 1b. Nanotechnology products and major application markets

|

|

|

Nanotechnology Products

|

|

|

|

|

|

|

|

Semiconductors, nanowires, lithography & print products

|

X

|

X

|

X

|

X

|

X

|

|

|

Coatings, paints & thin films

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Nanostructured particles, nanotubes & self assembly

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Drugs delivery, diagnostics & implants

|

X

|

|

X

|

X

|

X

|

|

|

Nano-bio, nanofluidics & tissue engineering

|

X

|

|

X

|

X

|

X

|

|

|

Catalysis, battery, fuel cells & filtration

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Environmental sensing & remediation

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Defence, security & protection

|

X

|

X

|

X

|

X

|

X

|

|

|

Electronic devices, displays & optoelectronics

|

X

|

X

|

X

|

X

|

X

|

|

|

Nano-manipulation, visualization, biomarkers & Q-dots

|

X

|

|

X

|

X

|

X

|

|

|

Computing, design, imaging tools, & products

|

|

|

|

|

|

|

|

Personal care, nanofluids & colloids

|

|

|

|

X

|

X

|

|

|

Convergence products (Nano-bio-IT-cognitive)

|

|

|

|

|

X

|

|

|

Other

|

|

|

|

|

|

|

Table 1c. Nanotechnology products and major application markets

|

|

|

Nanotechnology Products

|

|

|

|

|

|

Semiconductors, nanowires, lithography & print products

|

X

|

|

|

X

|

|

Coatings, paints & thin films

|

X

|

X

|

X

|

X

|

|

Nanostructured particles, nanotubes & self assembly

|

X

|

|

X

|

X

|

|

Drugs delivery, diagnostics & implants

|

|

|

X

|

|

|

Nano-bio, nanofluidics & tissue engineering

|

|

|

X

|

|

|

Catalysis, battery, fuel cells & filtration

|

|

|

X

|

X

|

|

Environmental sensing & remediation

|

|

|

X

|

X

|

|

Defence, security & protection

|

|

|

|

X

|

|

Electronic devices, displays & optoelectronics

|

|

|

X

|

|

|

Nano-manipulation, visualization, biomarkers & Q-dots

|

X

|

|

X

|

X

|

|

Computing, design, imaging tools, & products

|

|

|

|

|

|

Personal care, nanofluids & colloids

|

|

|

X

|

X

|

|

Convergence products (Nano-bio-IT-cognitive)

|

|

|

|

|

|

Other

|

|

|

X

|

|

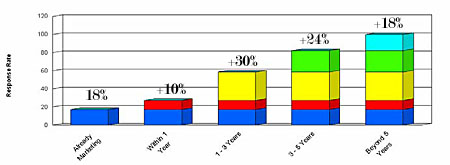

The U.S. leads the world in the generation and commercialization of nanoscale materials, manipulation tools and measurement innovations being applied to initially benefit a growing range of consumer products, digital storage, photovoltaic and semiconductor manufacturing industries. Myriad new applications of advanced nanocoatings, nanofilms and nanoparticles are being developed for introduction in the near-term (3-5 years) on a broader range of durable goods, consumer electronics and medical products (Figure 2). Nanoproduct applications are also being developed for the next generation semiconductor, energy, chemical catalysis and pharmaceutical/biomedical products. These would eventually mature into convergence products with higher sensory complexity, self-assembly and autonomous functionality, offering greater potentials for achieving the envisioned economic and societal impact.

Figure 2. Commercialization timelines indicate many new nanoproducts introductions in 2007-2011

Few Early Successes, Many Barriers

Organizations are proceeding cautiously in the development and commercialization of innovations such as active three-dimensional (3D) nanotechnology products that involve more direct human, societal and environmental impact. The nanomanufacturing industry for second generation (potentially disruptive) nanotechnology products is largely in its infancy – there are as yet no commercial devices based on true nanotechnology. The challenges facing the industry are not limited to the technology itself – rather, factors such as funding, commercialization strategies, regulation and a variety of socio-business issues will affect the long-term success of organizations entering this domain.

Due to the cross-disciplinary nature and broad societal implications of nanotechnology, few organizations possess the vertical integration and expertise needed to rapidly commercialize the envisioned second generation nanoproducts from conception to consumption. While there is much exploratory partnering and co-development within the industry, it will accelerate when the early nanotechnology applications transcending lengths of scale are able to demonstrate unquestionably superior performance of existing macro-scale products and systems at affordable cost, improved margins and higher reliability.

Large-scale, market-driven investments have been somewhat inhibited due to the lack of broader, in-depth understanding of nanotechnology’s complex material-process-property phenomena and its interactions with humans and the environment. These issues uphold the perception of uncertainty and long lead times in the industry. Therefore, the near-term impact of nanotechnology is likely to be fragmented, product-specific and evolutionary rather than revolutionary. The distillation of survey trends and executive attitudes indicates that while new applications will grow in the near-term largely by entrepreneurial means (e.g. technology push to seek niche applications), the longer-term success of a nanomanufacturing venture would depend on an organization’s core competency to partner with end-users and technology providers on the basis of platform nanotechnologies as well as its ability to meet defined performance object-tives (i.e. market pull factors) that help meet the customers’ bottom-line.

Increased Corporate and Public Awareness

Traditional manufacturing organizations, while interested in adopting nanotechnology, tend to be preoccupied with issues of short-term profitability and other approaches that prioritize returns and revenues over long-term growth (such as innovation and skills development). Recent pronouncements of the importance of nanotechnology herald a significant change in corporate and National attitudes. For prepared organizations, these trends represent new opportunity for paradigm shifts in change management to drive innovations for superior product lines, and realize improved investment returns on a global scale.

These positive trends are attributed in large part to the substantial seed investments, leadership and outreach efforts made by the NNI through R&D undertaken across academia, small and large businesses and the National Laboratory infrastructure. Concurrently, the increased branding of leading-edge consumer products and coining of science fiction terms with “nano” have also raised societal awareness, albeit with mixed results. They have the longer-term impact of preparing both, a new generation of know-ledge workers and informed consumers.

Survey respondents unanimously indicated that sustained government sponsorship is essential to attract the attention of senior manufacturing industry executives, investors, media and the public. Government support will expedite improved fundamental understanding of nano-technology and further clarify its potential, while fostering both, early markets and entrepreneurship towards the more advanced generation product applications.

Addressing Key Industry Barriers

The majority of the surveyed executives indicated their organizations faced considerable difficulty in nanomanufacturing, ranging from emergent technology issues, to raising capital for critical infrastructure investments, attracting the technical and business talent, connecting with early end-users, and producing competitively to meet new market applications and volumes.

Intellectual property (IP) issues and the sharing of knowledge were identified as areas of significant concern, as well as the lack of clear regulatory policy, which could impede industry, and impact the public’s reaction to future product developments. The continued education of the public, policymakers (State and Federal), government agencies and legislative bodies regarding these issues will result in clearer product approval pathways, robust standards and responsible practices, and thereby help ensure the continued dominance of the U.S.

While the nanomanufacturing industry faces unique challenges, similarities do exist with other recent technology waves such as the Internet and biotechnology, offering many lessons learned for formulation of sound anticipatory approaches. The answers to addressing the top-ranked challenges lie in continuing the aggressive National R&D investment policies for pursuing targeted investigations in fundamental nanoscale science, engineering and manufacturing technology. NCMS recommends several approaches for addressing the technology and business needs of the U.S. Nanomanufacturing Industry, while responsibly accelerating the benefits of new or enhanced products for societal benefit. NCMS further recommends the reclassification of the conventional definition of “small” business, as many of the largest organizations working with nanotechnologies would be considered small businesses by traditional industry standards. The following three broad categories are suggested in addressing the unique needs of current generation of embryonic nanotechnology businesses:

• Small nanotechnology businesses (less than 20 staff)

• Medium nanotechnology businesses (21 – 100 staff)

• Large nanotechnology businesses (over 100 staff).

Table 2 lists several approaches and National strategies for addressing clusters of identified barriers to the nanomanufacturing industry.

Table 2. Strategies to address critical identified barriers faced by the U.S. nanomanufacturing industry

|

|

|

High cost of processing

Process scalability issues

Lack of development tools

|

Collaborative R&D in value-chains

R&D to reduce/combine process steps

R&D in new equipment and to improve product yields

|

|

Long time-to-market

Unclear societal benefits

|

Government incentives for private R&D investments

Raise public awareness of benefits via successes

Promote supplier/end-user partnerships

|

|

Insufficient investment capital

|

Government investment in pre-competitive R&D

Stimulate market pull via end-users

Mentor start-ups for attracting investment

|

|

Intellectual Property (IP) issues

|

New business models for nanotech value-chains

Legal reform, train legal and judicial professionals

Streamline partnering with academia and National Labs

Facilitate supplier/end-user partnerships

|

|

Shortage of qualified manpower/

Multi-disciplinary aspects

|

Retrain tech workforce in basic science/testing/quality

Attract students to science and engineering careers

|

|

Regulatory and safety concerns/

Environmental and toxicity issues

|

Streamline permit/product approvals at agencies

Increase government-sponsored R&D

Broader dissemination of findings

Balanced legislation and regulatory practices

|

Accelerating Nanotechnology Developments

In order to maintain the current high momentum of innovation in nanotechnology advances critical investment, business and regulation-related issues need to be addressed concurrently and collaboratively by State and Federal policymakers. Long-term policies for National investment and the stimulation of public-private-research partnerships are imperative for developing the fundamental science base, facilitating technology transition to applied research, and demonstrating credible nanotechnology-enabled applications that are perceived as meaningful to our quality of life. The potential risks and hazards associated with the more revolutionary envisioned nanotechnology applications need to be assessed and disseminated by trusted sources to raise the public’s awareness, and thereby gain societal confidence. Strong incentives will help resulting innovations become swiftly translated into industry led technology demonstrations that enhance the public’s awareness and acceptance. This will require dramatic changes in business strategy and unprecedented levels of public-private regulatory collaborations to responsibly commercialize future nanoproduct applications. Such levels of integration do not presently exist.

Public-Private Collaborations

It is unlikely that the vast field of nanotechnology would reach the levels of maturity (like other traditional physical science-based industries did) within our lifetimes. This justifies the case for long-term government investment in nanotechnology. Private and institutional investments would grow faster when some of the fundamental technical issues of process scalability and cost of production of new nano-components as well as associated risks have been more comprehensively addressed.

Public-private collaborations in applied nanotechnology will hasten societal support when targeted towards nearer-term national concerns such as:

• Increasing productivity and profitability in manufacturing

• Improving energy resources and utilization

• Reducing environmental impact

• Enhancing healthcare with better pharmaceuticals

• Improving agriculture and food production

• Expanding the capabilities of computational and information technologies.

Critical Role of Government

Government can lead by defining and funding National priorities, and creating meaningful grand challenge incentives for early industrial adopters of nanotechnology. This will accelerate the broad-based translation of nanotechnology advances across multiple industry sectors.

Areas where greater government involvement in nanotechnology can have high National impact while leveraging substantially larger private investments include:

• Incentives favoring longer-term investments (e.g. tax-free bonds for financing, tax credits for capital investments, reduced capital gains tax rates, investment-specific loan guarantees, etc.)

• Promoting and streamlining strategic alliances for businesses and researchers with larger players or end-users

• Providing mentorship and business planning assistance to small businesses to identify key technology benefits and attract private capital

• Underwriting and disseminating “good science” research and public education into the long-term issues related to waste disposal, safety and regulations

• Undertaking tort and legal reform which will provide developers greater immunity and protection once their products are federally approved.

State governments and economic development bodies could assist small and large businesses link up in “ecosystem-like” neutral development environments by promoting leverage of nano-incubator and user facilities. By working with university and National Laboratory technology transfer organizations, they could facilitate simpler access to nanotechnology resources and training available in educational institutions, thereby stimulating new partnerships with entrepreneurs. Offering matching funds and other seed incentives to organizations pursuing Federal nanotechnology programs would provide further impetus for businesses and researchers to partner in commercialization ventures. Several progressive U.S. States have already initiated these next-generation technology partnerships.

|