Conductive additives are essential materials in the construction of Li-ion cells, and developments within the conductive additive space will be greatly influential in achieving manufacturers’ aims of enhancing their batteries’ energy density, lifetime, charging rates, and more. IDTechEx’s market report “Additives for Li-ion Batteries and PFAS-Free Batteries 2026-2036: Technologies, Players, Forecasts” highlights how advanced carbons such as carbon nanotubes (CNTs) and graphene are staking their claim within the conductive additive market, and what this means for the Li-ion industry in the following decade. IDTechEx forecasts that the conductive additive market will grow to be worth over US$1.5 billion by 2036.

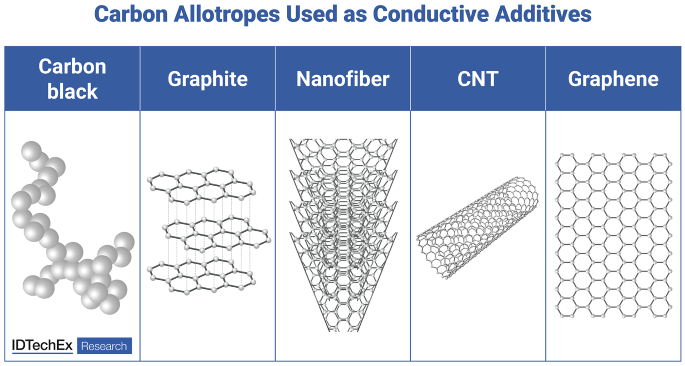

A range of carbon materials, including advanced carbons, can be used as conductive additives in Li-ion electrodes. Image Credit: IDTechEx

A range of carbon materials, including advanced carbons, can be used as conductive additives in Li-ion electrodes. Image Credit: IDTechEx

What are Conductive Additives?

Conductive additives play a critical role within the Li-ion electrode. They help achieve the cell’s intended performance by creating conductive pathways within the electrode to ensure proper electrical conductivity throughout.

The role of the conductive additive is most often played by carbon-based particles, with carbon black historically the additive of choice. However, IDTechEx’s “Additives for Li-ion Batteries and PFAS-Free Batteries 2026-2036: Technologies, Players, Forecasts” report highlights how advanced carbons, including carbon nanotubes and graphene, are superseding carbon black.

Why are Advanced Carbon Additives Growing in Demand?

Conductive additives are inherently inactive components within a Li-ion cell, meaning that while their addition optimizes cell performance and improves efficiency, they do not take part in the core working mechanisms of the cell. However, they still contribute additional weight and volume to the cell, which can compromise energy density.

In their quest for enhanced performance and greater energy density, manufacturers are looking beyond carbon black and towards other forms of carbon that can be used in smaller quantities within electrodes. A lower weight of conductive additive would lead to a lighter and more energy-dense cell, although the additive still must facilitate the same conductivity and efficiency as carbon black.

The ideal conductive additive thus has to be highly electrically conductive to be used at lower loadings, with a high surface area to contact electrode active materials. The material would ideally also be lightweight, relatively cheap, produced at scale, and compatible with current electrode production methods.

Understandably, few materials fit the bill entirely, but allotropes of carbon such as graphite, carbon nanofibers, CNTs, and graphene possess many of these traits, and the “Additives for Li-ion Batteries and PFAS-Free Batteries 2026-2036: Technologies, Players, Forecasts” report lays out the role these materials are expected to play in the future conductive additive landscape.

How Do Advanced Carbons Compare to Carbon Black?

Each of the forms of carbon comes with its own strengths and weaknesses, which will determine the extent to which it is used as a conductive additive. Carbon black and graphite are established materials used at scale in a number of industries. This makes them available and affordable, but their use as conductive additives requires relatively high loading quantities.

Contrast this with more emerging advanced carbons, such as CNTs and graphene (and to a lesser extent, nanofibers), which are relatively novel materials with enhanced conductive capabilities and surface area, but a wide spectrum of potential production methods, physical properties, and performance differentiation. The result is a material that can be used as a conductive additive in far lower loadings; however, the exact loading quantity, as well as the material price, are incredibly wide-ranging. Even among CNTs, for example, single-walled CNTs can cost 2 to 3 orders of magnitude more per kilogram than multi-walled CNTs.

Outlook

Ultimately, the decision on which conductive additive each battery manufacturer elects to use will be determined by trade-offs between a material’s cost, loading quantity, and potential performance benefits, among other factors.

The IDTechEx report offers a more in-depth analysis of how these trade-offs have already shaped the market, highlighting market-leading materials and key players. Materials also have to be compatible with existing production processes, but CNT and graphene technology will continue to mature, and manufacturers must still consider such wider material trends.

“Additives for Li-ion Batteries and PFAS-Free Batteries 2026-2036: Technologies, Players, Forecasts” brings together all of the above trends and more, highlighting how the conductive additive market is set to be transformed by the evolving demands of Li-ion manufacturers and advancements in the carbon materials market.

IDTechEx’s report breaks down key demand contributors, performance capabilities, costs, and major producers for each conductive additive material in greater depth, providing insights into how these will impact their use in Li-ion cells. 10-year granular forecasts for material demand and market size are provided and segmented by additive, charting the path forward for the conductive additive industry out to 2036.